A Case for Shorting Utility Stocks.

Electric utilities are probably not the first place you’d look to find stocks to sell short. They are traditionally known as safe, defensive stocks because they provide a basic essential service, have been around a long time, earn a stable regulated return, and typically pay steady dividends.

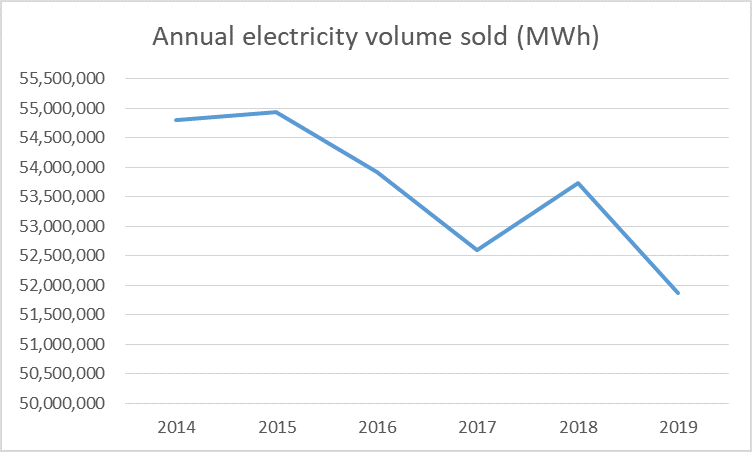

However, there are some noticeable trends that are adversely affecting some domestic utilities from which we can create a bearish thesis:

The rise of community choice aggregators (CCAs)

CCAs are local governmental entities that buy electricity on behalf of retail electricity customers within a given region. These entities are being formed because residents in progressive regions wish to take control over their source of power, which usually means procuring more renewable energy. To date nine states have passed CCA-enabling legislation and several more states are seriously considering it. Some of these states even automatically enroll new residents of a CCA service area directly into the CCA instead of the local utility.

The local utility remains in the picture as the CCA still depends on it for transmission and distribution services, but the utility loses the customer relationship when a customer enrolls with a CCA. The total number of customers enrolled in CCAs nationally was only about 5 million as of the end of 2017 but enrollment is growing fast. As of September 2020 the California CCA trade group claims California itself has 10 million customers.

High utility basic service rates

There is a pretty wide dispersion in the cost of electricity across the country. The average price is about $0.12/kWh, but utilities in some places charge as much as triple that level. Some extreme instances are because of locations locked into a high cost of living, such as islands (e.g, Hawaii). However some states have very high electricity costs due to local regulations, market structures, and the composition of their existing power generation fleets. Prime examples are Massachusetts, California, Connecticut, and Rhode Island.

Electricity is often one of the biggest regular bills paid by residents and businesses alike. Ever since power generation became centralized and monopolized by utilities in the early 20th century, customers have had no choice but to buy power from them. As with any high-cost incumbent monopoly in any industry, high-cost utilities are ripe targets for disruption.

The rise of solar and energy storage

“Distributed energy generation” is the term used to describe users of energy (homes and businesses) becoming their own producers. Every kilowatt-hour that a consumer produces onsite is one kilowatt-hour not purchased from the utility. What’s more, net metering laws have allowed consumers in most states to sell excess produced energy back to the utility. Although the users by and large remain connected to the grid, they are drawing less energy from it.

Utilities have pushed back on paying full price for excess energy delivered from customers via net metering. However, onsite solar is now increasingly coming paired with batteries to store excess energy. This means two things: 1) customers can generate even more solar energy, if they are not limited by space on their roof or real estate; and 2) the combination makes it more realistic for customers to leave the grid entirely.

Declining populations

People are moving out of some states, and particularly some regions in certain states. The reasons are varied such as people moving out of rural areas that have little economic opportunity (time will tell if the COVID crisis offsets this trend), declining birth rates, and opposition to immigration. Whatever the reasons, an economy cannot thrive when the demographics are unfavorable. Electrical utilities do not go “seeking out” new territories and customers; they are required by law to serve customers within a fixed region. If that region suffers, the utility will suffer.

Advancing deregulation of electricity markets

Originally, utilities owned the entire electricity supply chain - power plants that generate energy, transmission lines that transmit energy over long distances, and distribution lines that bring the energy into individual homes and businesses. The first restructuring step happened in the 1970s at the federal level when independent companies were allowed to own power plants and sell the energy generated to utilities. More recently, further deregulation has taken hold in many states allowing for retail suppliers to compete directly with utilities. These suppliers can buy electricity in the wholesale markets or via contracts with independent power producers, and then market the energy directly to end users. Similar to the CCAs, these retail suppliers directly compete with utilities for customers.

Wildfire risk

Droughts caused by climate change are behind the increasingly problematic fire seasons in the western U.S. Utility transmission lines criss-cross the dry expanses of the West to transmit power over long distances and to provide power to rural communities. If utilities do not trim trees and clear brush near their equipment, a branch falling on a live wire can be all it takes to ignite a fire which then easily spreads due to all of the dry vegetation which serves as fuel.

Furthermore, California applies “inverse condemnation” to utilities. This means that utilities are liable for damages and fees when their assets ruin other people’s property, whether the utility acted negligently or not.

Below is a summary of the states that are most exposed to each of the factors mentioned above. The color coding calls out the states that are currently exposed to several factors at once:

The following is a primer on a handful of investor-owned (i.e. publicly traded) utilities based in these states where many fundamentals are working against them, and thus could be good candidates to short:

Pacific Gas & Electric (NYSE: PCG)

Territory: Central and Northern California

In progressive California, PG&E is clearly losing customers to solar and CCAs. The company has also been blamed for starting some of the bad wildfires that have ravaged the state in recent years. The wildfire liabilities alone drove PG&E into bankruptcy in 2019, from which it has since emerged. Does that mean it is too late to short the stock? It certainly has already lost a ton of value, but all of the adverse fundamentals are still in place and the wildfires seem only to be getting worse every year due to climate change.

Southern California Edison (parent: Edison International (NYSE: EIX))

Territory: Southern California

San Diego Gas & Electric (parent: Sempra Energy (NYSE: SRE))

Territory: Southern California

SCE and SDG&E are subject to the same factors as PG&E in California. Being largely desert, Southern California does not have nearly as much vegetation to fuel fires as does PG&E’s territory. However, these two utilities’ equipment have also been implicated in fires, both recently and in the past.

SDG&E’s parent Sempra Energy also owns utilities and natural gas businesses in Texas, Mexico and elsewhere. SDG&E accounts for a little less than half of Sempra’s total revenue. This provides a fair amount of diversification that might make the stock less exposed to the risks discussed here.

Edison International, on the other hand, is not similarly diversified. SCE comprises virtually all of the parent company’s business.

Ameren Illinois (NYSE: AEE)

Territory: Central Illinois, Missouri

Exelon (NASDAQ: EXC)

Territory: Midwest / East Coast

Exelon is a holding company for a number of utilities serving Illinois, Pennsylvania, Maryland, Delaware, and New Jersey. The company actually generates most of its revenue from Constellation, which owns power plants and sells electricity and natural gas in many different regions.

All of the utilities are in deregulated states, which is not favorable. However the company’s size and diversification (across regions, and a big presence in generation to balance basic utility services) suggest that Exelon as a whole is less vulnerable than other utility stocks.

Eversource Energy (NYSE: ES)

Territory: New England

Eversource owns utilities in Connecticut, Massachusetts, and New Hampshire. 85% of electricity sales are in the first two states, both of which are exposed to many of the negative fundamentals outlined above. The company has pretty high debt compared to its peers, and capital expenditures have exceeded operating cash flow for the last several years.

Outside of its utility operations, Eversource invests a material amount into offshore wind via a partnership with the Danish company Orsted.

National Grid (NYSE: NGG)

Territory: U.S. Northeast / U.K.

National Grid owns utilities in New York, Massachusetts, and Rhode Island, all of which where CCAs are enabled and electricity costs are high. It also has high leverage like Eversource. However, National Grid is actually based in London and also owns transmission and gas assets in the U.K. The U.S. businesses account for about 67% of overall revenue. The global diversification would provide some buffer if the U.S. utilities were to continue declining.

Avangrid (NYSE: AGR)

Territory: U.S. Northeast

Avangrid owns electric and gas utilities in New York and Connecticut. In New York, the company serves the upstate regions that are particularly struggling with population declines. This compounds the issues in the progressive state where CCAs and distributed solar are expanding quickly.

On the other hand, about 20% of Avangrid’s business is power generation focused on high-growth renewable energy including offshore wind. Also, the company recently announced it is acquiring PNM Resources, a utility serving New Mexico. Finally, Avangrid itself is a subsidiary of Iberdrola, the Spanish energy company with a growing global presence.

Thus the exposure to poor regional factors in New York seems to be offset by geographic diversification and support from a large parent company.

In conclusion, I would say that PG&E, SCE, and Eversource are facing the most unfavorable circumstances out of the utilities covered above and are worth looking into further for a potential short position. While this is a starting point, I should point out that an investor needs to do more homework before initiating any position. This post covers trends in electricity, but many utilities also provide natural gas and water, and many have additional businesses under unregulated subsidiaries. Also, a utility’s relationship with its state public utility commission is critical as that entity determines the rates a utility can charge customers.

This discussion has only covered industry fundamentals. Of course, analyzing company financial statements and assessing stock valuations are also very important in order to arrive at an investment decision.

The term “utility death spiral” came into vogue some years ago to describe a fundamental decline in the utility business model due to customers leaving the grid. A shrinking customer base means the utility must charge the remaining customers more; that reduces the value proposition for the remaining customers, inducing more of them to leave the grid. Although this vicious cycle hasn’t actually left any U.S. utilities for dead yet, it may only be a matter of time before we see these forces tip a particularly poorly positioned utility over the edge.

Sources:

EIA

https://cal-cca.org/